The transition from a 9 to 5 job (no matter how soul-deadening) to a lifestyle as a digital nomad (no matter how liberating) is a scary transition to make.

There’s a lot more to consider than just “Quit your job and travel the world!”–particularly from a financial standpoint.

This post aims to take all of the guesswork out of preparing financially to leave your 9 to 5 job for location independence by giving you a concrete plan of action you can start today.

By the end of this post you should know:

- Exactly how much you’re currently spending each month

- At least 5-10 places where you can eliminate costs and find savings

- Where you can sell your stuff when you start downsizing

- How you can start earning extra money on the side

- Where to put the money you’re saving

- Where you want to live and travel

- How much money you’ll need to survive there each month

- Cost of flights to and from your destination

- The exact amount of money you’ll need to save to comfortably leave your job

Simply follow this process and complete each action step as you go, and you’ll be well on your way to building your dream digital nomad lifestyle before you know it.

Transition from 9 to 5 employee to #digitalnomad by following these steps! #financialplanning Click To TweetBefore you begin, download my Digital Nomad Financial Planning Worksheet and print it out so you can follow along with the prompts.

How to Prepare Financially to Leave Your 9 to 5 Job and Become a Digital Nomad

Please note: This post contains affiliate links, which means I may receive a small commission if you make a purchase, at no extra cost to you. Thank you for supporting The Sweetest Way!

Step 1: Calculate Your Current Monthly Spending

If you’re like most people, you don’t pay much attention to where you’re spending your money each month, or even how much of it you’re spending.

No need to be embarrassed–we all do it, and this is a judgment-free zone.

But, in order to transition from your 9 to 5 job to a new life as a digital nomad, you’ll need to start paying much closer attention, because financial preparedness will be your safety net and savior when you’re suddenly without that stable income each month.

To complete this first step, you’ll simply need to take stock of EVERYTHING you’re spending money on each month–whether it’s a necessary cost such as rent or a luxury expenditure like the new jacket you just had to have.

This includes things like cable and your phone service, movie rentals, dinners out with friends, new clothes, gas and car insurance, your daily latte, books, and whatever else you have a habit of spending money on each month.

Estimate how much each item costs you in a given month, and tally up your total expenditures.

If you’re like most people, this number will likely shock you a little bit, and you’ll immediately start noticing where spending can be eliminated and savings can be found.

Action Step: Grab a pen and paper and do a brain dump–list everything you spend money on monthly including both essential (rent) and non-essential (new clothes) expenses, including a specific dollar amount for each.

Step 2: Calculate How Much You’ll Actually Need as a Digital Nomad

As a digital nomad, chances are you plan to leave your comfortable bubble and travel outside of your home country. This is great news for us U.S. citizens because living expenses will be lower in many destinations around the world.

Whether you’re drawn to Warsaw, Kuala Lumpur, Hong Kong or Quito, it’s important to know how much you’ll expect to pay in living expenses for things like accommodation, food, transportation, and the all-important WiFi connection.

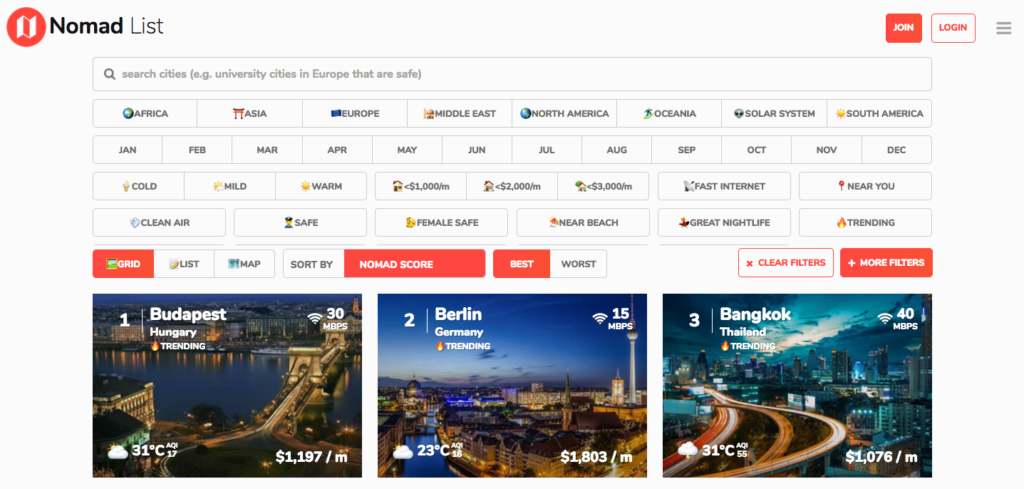

Nomad List is an excellent resource for digital nomads that allows you to quickly filter destinations by cost of living, weather, nightlife, safety, internet speeds, region, and more. If you want a quick estimation of how much (or how little) money you can expect to live on in a certain city, this site should be your first stop.

Dig deeper into each city to discover its overall “Nomad Score” according to other remote workers as well as tons of other factors worth considering, such as healthcare, walkability, air quality, availability of working spaces, whether locals are friendly to foreigners, and whether English is widely spoken.

You can even chat with other nomads about their experiences, get advice, and make new friends before you arrive.

Once you’ve zeroed in on your ideal digital nomad destination, write down your estimated monthly living expenses. Then, according to your own acceptable level of risk, multiply that number by 6, 8, 12, or however many months’ worth of living expenses you want as a cushion while you build up your freelancing career or online business.

If you’ve already started building up your side hustle and have some money coming in, you’ll probably be safe having just a few months’ living expenses already covered. If you’re not sure when you’ll start earning, you should save more to account for the uncertainty.

Action Step: Determine the monthly cost of living in your intended destination and multiply that number by how many months’ worth of a safety net you want to have. Record this number on your worksheet.

Step 3: Add the Cost of Flights To/From Your Destination

Next, add to that number the cost of a flight to and from your intended destination. You most likely won’t be buying a round-trip flight since your trip will be open-ended, so I suggest finding a last-minute one-way fare and multiplying that amount by two.

It’ll give you peace of mind to know you have enough funds to not only get you there but to get you home should you change your mind or an emergency arise.

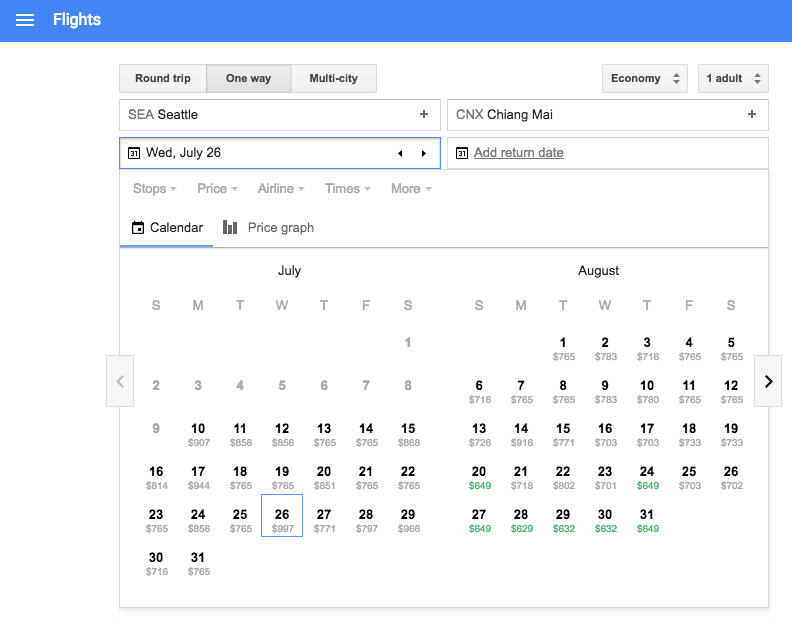

Use Google Flights to quickly find a last-minute, one-way fare from your home airport and multiply by two to get the amount you need to save for air travel.

If the one-way fare is $997, you’ll need to save roughly $2,000 for flights. With proper planning, you won’t be booking your flights at the last minute, but this method will ensure you save more than enough to cover the cost.

The number you now have should be:

Living Expenses for X months + (One-Way Airfare x 2) = Savings Goal

Action Step: Calculate your savings goal using the above formula.

Step 4: Eliminate Unnecessary Costs

Returning to the list of costs we came up with in Step 1, it’s time to start eliminating unnecessary expenses so you can start working toward your savings goal.

You don’t have to take an all-or-nothing approach here, necessarily. If you spend $20 per week on lattes and you’re not willing to give them up entirely, you can still find significant savings by cutting that number in half.

What it will all come down to in the end is how quickly you want to reach your savings goal and how much of your current lifestyle you’re willing to sacrifice to make it happen.

If you’ve calculated that you’ll need a savings cushion of $6,000 before you can comfortably take the leap and leave your 9 to 5 job (and you have no savings at present), you can reach that goal in just one year by putting away $500 per month. If you save $300 per month, reaching the same savings goal would take closer to two years (20 months).

Of course, you’ll contribute to your savings goal in other ways as well, which I’ll get to below.

The most obvious places to start eliminating costs are the purchases that are born out of wants, not needs:

- You do not need a new pair of jeans if you already have several at home.

- You do not need to go out to dinner with friends every week–why not have them over for a potluck instead?

- You do not need your cable service when you could watch shows and movies on Netflix just as easily.

- You do not need your gym membership; have you ever tried at-home workouts like Kayla Itsines’ BBG?

- You do not need a new armchair in your living room–you can’t take it with you when you move, anyway.

If starting a new life of travel is truly your top priority, these things should be easy to eliminate–they are not getting you any closer to your goal and are, in reality, only preventing you from reaching it.

Here are a few more simple lifestyle tweaks you can make that will add up to significant savings:

- If you must shop for clothing, shop second-hand.

- Take the bus or walk to work twice a week.

- Bring your own lunch to work every day.

- If your friends want you to come out for drinks, offer to be the DD.

- On Sunday, plan your meals for the entire week so you buy only what you need at the grocery store.

- Start a new tradition of spend-free weekends.

Keep an eye out, too, for expenses that maybe can’t be eliminated, but can be reduced. For example, could you take a roommate or move in with family to reduce your living expenses? Could you buy generic products versus brand-name products? Could you reduce your water bill by taking shorter showers?

Action Step: Write down a list of 5-10 costs you could easily eliminate starting today. Write down an additional 2-3 costs you could easily reduce.

Step 5: Start Saving the Money You’re No Longer Spending

Assuming you weren’t making any of your unnecessary purchases with credit cards (and I hope to god that you weren’t), the money you were once spending on items that you wanted but didn’t need can now go straight into your savings account.

At this point, you’ll be covering your basic essentials each month (rent, utilities, food, transportation, healthcare, etc) with just a little leftover for the few fun things you’re not willing to compromise.

The rest? Save it all, baby.

Do not, I repeat DO NOT keep that money in your checking account where it can easily be spent. Rather than leaving it all in one account where temptation (and ease of access) is likely to get the best of you, move the amount you will no longer be spending to a high-yield online savings account–out of sight, out of mind.

Any one of these online savings accounts is a better option than simply opening a savings account with your bank. You won’t be able to access the money anywhere near as easily (transfers will take several days, meaning you can’t spend this money on a whim) and you’ll earn a far higher interest rate than you would with your bank.

Action Steps: Calculate your minimum monthly contribution to your savings account from the costs you’ve already decided to eliminate. Open an online savings account and make your first deposit, however small, to prove to yourself that you’re serious about making your new life a reality.

Step 6: Sell Everything You Don’t Need

Another important step in preparing to transition to a digital nomad lifestyle is downsizing.

Remember, you can’t take most of your things with you, anyway, and you probably don’t want to pay for a storage unit for months on end while you’re away.

If you rid yourself of the majority of your possessions, you may be able to sweet talk a friend into storing one box or suitcase for you–the rest you should be prepared to travel with. Adopting a minimalist approach to life will help you greatly in a nomadic lifestyle, so start practicing now.

The good news is, downsizing is just one more way to start working toward your savings goal so you can reach it even faster.

Before you start dumping things into a box bound for a donation bin, set aside the items that may still hold some value. There are so many ways to sell things online these days that it’s worth a shot even with small stuff.

Nature10/Shutterstock

Here are some places to start listing your gently used goods for sale:

Cross-list your items on various sites to reach a wider audience and up your chances of snagging a sale.

If you have a lot of clothes to get rid of and they’re in excellent condition, try your hand at selling them through a local consignment shop or participating in thredUP’s Clean Out program. If you’re ready to get rid of lots of stuff all at once, host a yard sale.

Action Step: Round up a few things you don’t need anymore and create listings for them on Craigslist and Letgo. Once you make your first sale, you’ll be motivated to sell more! Put the money (or equivalent amount) directly into your savings account.

Step 7: Start Earning More Money

The last part of the savings equation is one far too many people overlook–earning more money! There are only so many costs you can eliminate and only so many things you can sell, but your earning potential? The sky is the limit, yo!

Chances are, you have a skill that someone else would find valuable, a skill that you could monetize in your free time. Building a side hustle around this skill will help propel you to your life as a digital nomad, and could even be your first source of remote income.

I shared my own success story of starting a Pinterest consulting side hustle and the steps it took to get there; your new freelancing or consulting career could be just a few bold choices away from where you are today.

To get a freelancing side hustle off the ground, check out these online marketplaces and start listing your services. But, don’t rule out traditional job search sites for freelancing opportunities.

Need some ideas for your new side hustle? Try these on for size:

- Teaching English

- Proofreading and editing

- Test prep tutor

- Web and graphic design

- Niche freelance writer

- Social media management

- Video editor

- SEO consultant

- Bookkeeper

- Virtual assistant

Alternatively, if there are opportunities for you to earn more at your current job, now’s the time to pursue them. Can you take on more shifts? Are you in a position where you can negotiate a raise?

Lastly, never underestimate the power of picking up odd jobs. I once made a great hourly rate teaching beginning Spanish to kids in the area, my partner teaches guitar lessons on nights and weekends, and we’ll never miss an opportunity to house sit for friends who are away.

If you want to start earning money for the stuff you already do online, like watching videos and playing games, try cashback sites like Swagbucks and Ebates.

Action Step: Brainstorm ways you can potentially make more money on the side, whether by starting a side hustle, asking for more hours at work, picking up odd jobs, or taking online surveys. Every little bit helps!

Singkham/Shutterstock

Step 8: What To Do If You Have Debt

Can you become a digital nomad if you have debt? Well, it depends. There’s no one-size-fits-all answer to this question, but I have some opinions of my own which I will share with you here.

If you have debt with a manageable repayment period and you come up with a plan to continue making payments once you become a digital nomad, by all means, go and see the world.

Some examples of this might be student loan debt (if you’ve included the payments when calculating your monthly living expenses) or a mortgage (if you have renters who are paying it in your absence).

If, on the other hand, you’ve got thousands of dollars worth of credit card debt and have only been making the minimum monthly payments until now, it’s best if you pay down that debt using the money you’ll save through the lifestyle tweaks we’ve already discussed before the interest eats you alive and forever crushes your dream of financial (and location) independence.

And this isn’t just hearsay, I’m speaking from experience–I’ve been in the position of struggling to climb out of credit card debt and have since vowed to never EVER let it happen to me again. I suggest you don’t, either.

Credit cards and their insane interest rates are no joke, friends, and if you’ve gotten yourself into trouble and think moving to another country will solve your debt problem, it won’t. It might seem like the smart move to live somewhere cheap so you can pay that debt down faster, but the caveat here is you still need to be bringing money in.

The ONLY time I might suggest this as an option is if you can get a remote job with a steady salary before you leave and you choose a super-affordable destination.

Bottom line: If you have credit card debt, you’re better off eliminating it before you start your new travel lifestyle.

Action Step: Do you have debt? If not, great! Your only job is to keep it that way. If yes, determine how you will continue to make payments once you move abroad, or if you need to repay it before you move, figure out how many months it will take to pay down the balance with the money you are now saving.

Step 9: Remote Work, Freelancing, or Entrepreneurship: Figuring Out Which Path is Right For You

Megan Kathleen Photography

Now that you’re on the right track to financial preparedness to leave your 9 to 5 job, it’s time to start thinking about which path you will take to start earning money in your new life as a digital nomad.

Will you get a remote job for more stability?

Will you start a side hustle, building your own freelance career using skills you already have?

Will you build your very own online business and take on the risks and the pressure associated with entrepreneurship?

If you want to dive deeper into this topic, head to this blog post and take my quiz to determine which path your personality type is best suited for.

There are benefits and drawbacks to each path, and only you can determine which one makes the most sense for you.

For further reading, check out some of my related blog posts:

- Land Your Dream Remote Job in 5 Simple Steps

- Want to Become Location Independent This Year? Consider Starting a Blog

- 10 Blogging Income Reports That Prove Blogging Isn’t “Just a Hobby”

- How 15 Location Independent Bloggers Make Money Working From Anywhere

- How I Created a Consulting Side Hustle (and the Exact Tactics You Can Steal)

- 12 Creative Ways to Make Money Online Without a Blog

- How I Earn Money Online as a Digital Nomad

For even more location independent career inspiration, check out my interview series, Location Independent Success Stories and learn from nomads who are making it work:

- How to Travel the World as a Freelance Social Media Manager

- Working from Anywhere as a Self-Taught E-Commerce Marketing Specialist

- How One Couple Turned Their Travel Obsession Into a Lifestyle

- Living the Digital Nomad Lifestyle as a Professional Translator

- Freelance Your Way to Location Independence: A Copywriter & Copy Editor Tell All

- From Aspiring Actress to Remote Worker: In Search of Flexibility

- How This Blogger Built Her Dream Location Independent RV Lifestyle

Your Final Action Step: Do some research (or some deep soul searching) and then leave me a comment on this post telling me what digital nomad career path you want to pursue. Remember, this goal can change over time, but by putting it out into the universe, you’re more likely to follow through (and I’ll be here to help keep you accountable). Ready, go!

Featured image by Megan Kathleen Photography